Along with reading this page to get a quick bookkeeping overview, we always recommend meeting with a CPA (certified public accountant) or bookkeeper before you open your doors. A financial expert can give advice specific to your unique business and give you a more in-depth look at basic bookkeeping principles. If you absolutely want to be connected with hundreds of apps that offer hundreds of tasks, Xero may be right for you. A great fit for e-commerce startups and small businesses, Xero has added a ton of features in recent years, and it offers excellent integration across the board. If you’re using accounting software, the accounting cycle is automated, reducing the number of steps drastically. Accounting software applications always include a default chart of accounts that you can use immediately.

The single-entry method suggests entering each transaction only once. For example, upon a sale, you record the sum of the purchase in your account. It’s a rather simple method of bookkeeping that doesn’t provide for your inventory, for example. A cash flow statement, as the name suggests, gives a report on the movement of money (and cash equivalents too) from and to your company during a specific period of time. So let’s take a look at how to do basic business accounting, understand what your books tell you, and how to manage them efficiently with helpful software.

We really hope that we have given you a wide range of options to help you decide. While their transactions may not be as large, small businesses use the same system of accounts that large companies use. For the ambitious business owner seeking a stable foundation, Initiate Business Checking gives you digital tools and support you can count on. It’s designed for businesses with lower balances and fewer financial transactions. Keep copies of all invoices sent, all cash receipts (cash, check, and credit card deposits), and all cash payments (cash, check, credit card statements, etc.). Business accounting is the process of gathering and analyzing financial information on business activity, recording transactions, and producing financial statements.

More so even than owners of large companies since they can’t usually delegate all that work to business accounting professionals simply due to the costs. That’s why understanding the essential principles and terms in accounting is so important for them. All online accounting services simplify the accounting process, but there will undoubtedly be times when you have questions. Some apps also provide context-sensitive help along the way and a searchable database of support articles.

So, how is that different from the checking account you already have? The main difference between a business checking account and a personal one is its intended purpose. Though you might be able to move funds into or out of it, a personal account isn’t set up with work in mind, and may have certain limitations.

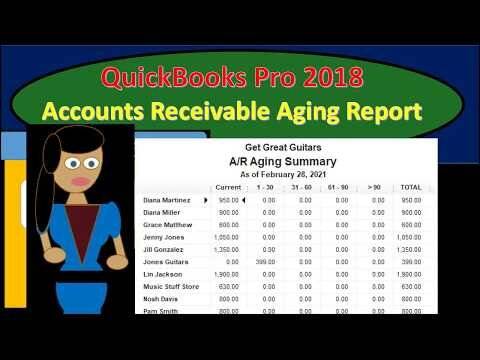

Intuit QuickBooks Online: Best for Small Businesses

Instead, read the list below for the best banks for small businesses. Look at the item in question and determine what account it belongs to. For example, when money comes from a sale, it will credit the sales revenue account. Making sure transactions are properly assigned to accounts gives you the best view of your business and helps you extract the most helpful reports from your bookkeeping software.

Enter some basic business information and we’ll send you up to five free quotes customized to your unique bookkeeping needs. Alternatively, in-house or outsourced bookkeepers can update your books for you, typically for a monthly fee. But whether you plan to do bookkeeping yourself or outsource it to an accountant, it pays to understand the basics of bookkeeping. If you’re not entirely comfortable using a software application, Sage Business Cloud Accounting is designed for you. A good fit for sole proprietors, Sage Business Cloud Accounting makes it easy to track inventory sales and services. When all of your transactions have been entered, you’re ready to run your financial statements.

Early setup involves creating an account and answering questions like when your fiscal year starts and what type of business you have. Individuals who are successful bookkeeping professionals are highly organized, can balance ledgers accurately, have an eye for detail and are excellent communicators. When manually doing the bookkeeping, debits are found on the left side of the ledger, and credits are found on the right side. Debits and credits should always equal each other so that the books are in balance.

Calculate annualized numbers for your business tax return.

When starting a new venture, any small business owner needs to quickly learn many aspects of business management. You essentially become a jack of all trades – from sales, through customer care all the way to marketing. While you’re thinking about your money, you might also like to consider our reviews of online payroll services and personal finance managers. Most small business accounting services also offer the option to import existing lists in formats such as CSV and XLS.

You have been recording journal entries to accounts as debits and credits. At the end of the period, you’ll “post” these entries to the accounts themselves in the general ledger and adjust the account balances accordingly. If a general ledger is like a book, a chart of accounts is like a book’s table of contents—it’s a list of all the accounts your business uses to record transactions. In this metaphor, each account is like a chapter of a book, and individual journal entries are kind of like the pages of each chapter. Alternatively, you can pay an accountant, bookkeeper, or outsourced accounting company to manage your accounts and ledger for you. Sage Business Cloud Accounting starts at $10/ month, but for complete accounting functionality, you’ll want to choose the full-service plan at $25/month.

Most notably, Plooto offers business accounts payable and accounts receivable automation, which helps you collect on past-due bills. The platform is also easy to set up and use, allowing you to do everything by yourself to get your accounting software up and running. However, if you want extra assistance, Intuit offers access to professional bookkeepers and accountants who can help you configure the software in a way that makes sense for your business. Additionally, QuickBooks Online allows you to create custom invoices and forms so your company’s branding is always at the forefront of client-facing communications. Accounting services pay special attention to your company’s expenses—not bills that you enter and pay (though some support this), but rather other purchases you make.

Best small business accounting software of 2023

It is designed by the US financial software company Intuit, which also creates TurboTax. QuickBooks Online is not only used by the majority of small business accounting specialists, but there are also endless online training resources and forums where you can get support when you need it. One main dashboard provides easy access to all accounting features, enabling more fluid and effective bookkeeping. Although the majority of accounting software is simple to use, accurate financial report creation requires a general understanding of accounting principles. Because of this, many companies employ bookkeepers or accountants to monitor or review their books. Businesses can easily access their books at the same time as their bookkeeper or accountant with cloud-based online accounting software.

- This method offers a true snapshot of your assets and debts at any given time.

- You’ve created your set of financial accounts and picked a bookkeeping system—now it’s time to record what’s actually happening with your money.

- While there’s cloud-based convenience there are also variations on the theme, depending on what kind of business accounting needs you have.

- If these invoice, bank or billing limitations are are an issue then the Xero Growing plan looks like a better deal.

The key is to ensure every transaction is recorded correctly and in the right account. The cash basis is easier to use, but the accrual method of recording transactions gives you a clearer picture of actual revenue and expenses during a particular period. Most small businesses that don’t carry inventory choose the cash basis. Large and inventory-heavy businesses may need to use the accrual method. Opening a business bank account is easy once you’ve picked your bank. Here are some of the most common documents banks ask for when you open a business bank account.

Spreadsheet software

Managing business finances doesn’t have to be the bane of your professional existence. Nor does it have to take you away from the personal reasons you started your company in the first place. Bookkeeping is essential to the vitality and long-term success of any small business. Primarily, you need to have an accurate picture of all the financial ins and outs of your business. From the cash you have on hand to the debts you owe, understanding the state of your business’s finances means you can make better decisions and plan for the future.

Small Business Checking Accounts

All the accounting services reviewed here come with default settings that you may need to change. For example, do you plan to use specific features such as purchase orders and inventory tracking? You can usually turn tools on or off, which can help you either simplify the user interface or maximize the functions available to you. Wave is one of only two online accounting services that you can use for free, unless you need payroll and payments, which you do have to pay for.

You can split transactions that should be assigned to multiple categories, make notes, and reconcile your accounts with your bank and credit card statements. Zoho Books is the small business accounting element of Zoho’s ecosystem of productivity applications. Your accounting data can be tightly integrated with numerous related apps and functions, like CRM, customer service, and email. The Unlimited Checking option of Capital One’s small business banking platform has online banking options like bill pay and mobile banking, as well as perks like unlimited no-fee digital transactions. Account holders can send out up to five domestic wires each month for no charge.

Melio: Best Accounts Payable Tools

A dated interface, lack of mobile access, and the requirement to install the software locally keep it from receiving a higher score. If you use QuickBooks, payroll software, or another accounting tool, you may want to work with a bank that allows you to integrate multi step income statement format, examples the data from your software. It’ll be a lot more efficient to balance your books if withdrawals automatically show up in QuickBooks. If you use PayPal or Square, you may find it helpful to have those transactions show up in your checking account too.

It looks at the balance or the ratio between those 3 elements – how what you now own relates to what you invested and what you owe at a specific point in time. Please include what you were doing when this page came up and the Cloudflare Ray ID found at the bottom of this page. PCMag supports Group Black and its mission to increase greater diversity in media voices and media ownerships. Integrity Network members typically work full time in their industry profession and review content for Accounting.com as a side project.

In addition, maintaining accurate records ensures that business owners remain responsible for tax obligations to the government and their employees. QuickBooks Online topped our list because of its scalability, training resources, and mobile app. There are four different plans, and businesses can get a 10% discount if they choose to pay yearly rather than monthly. Additionally, FreshBooks often offers discounts for your first months of membership. The four plans are Lite ($17/monthly or $183.60/yearly), Plus ($30/monthly or $324/yearly), Premium ($55/monthly or $594/yearly), and Select, which is a custom service with custom pricing. This software has a clean interface and also fully integrates with a third-party payroll service.

Wave can also offer professional accounting coaching from qualified experts. Our products and services may vary by location, and a ZIP Code helps us provide accurate information. If you choose not to enter a ZIP Code you’ll be redirected to our home page.